Just like almost all business sectors, the real estate market has been impacted by COVID-19. This is particularly the case for property transactions, as meeting in-person is so important at numerous points when purchasing a property, from viewings and inspections, to contract signings.

However, the market is still functioning in spite of statewide lockdowns, and buyers, sellers, lenders, and realtors are all adapting to this new normal. And one thing that many are now turning to do is virtually closing on properties during COVID-19. We’ll explain exactly how to do this in this article.

NEED ADVICE? SPEAK WITH A SEASONED ACCOUNT EXECUTIVE TODAY

Also of interest to you could be our blog on private money lending during COVID-19.

Home Inspections – Check Your State’s Rules

Home inspections have to be carried out by a licensed inspector, and can’t be carried out virtually. So the first thing to consider is whether a property inspection can still go ahead. This depends on the state you’re in. If you’re in a state with stay-at-home orders and real estate isn’t considered an essential service, you won’t be able to get a home inspection.

Real estate’s status as an essential or nonessential service during the coronavirus is constantly shifting. For state-by-state updates, you should visit the national association of realtors.

If real estate services are deemed essential in your area, in-person inspections are going to look a lot different. Agents, buyers, and sellers are using video conferencing tools to attend inspections virtually or to review the inspector’s conclusions at a later date. And if your property is being inspected and you’re concerned about safety, you can ask the inspector to wear PPE during the inspection, including a face mask and gloves.

In addition, it may also depend on the property type. If it is a vacant property, only the owner of the property can provide contact-less access via a lockbox or key code or by opening the door when legally necessary and in accordance with appropriate social distancing and cleaning/disinfecting protocols. Moreover, if the property is not vacant, and/or if the property is an apartment within a larger building that will not allow any non-residents from entering, then the inspector will not be permitted to conduct the inspection either.

Despite these hurdles, it’s highly recommended you don’t skip on a home inspection. This is especially the case if you’re buying a distressed property, such as with a fix and flip loan. In these exceptional circumstances, you may be able to negotiate additional time for a home inspection to take place, as part of a COVID-19 clause (more on that later).

Appraisals – Can Be Conducted Without Visiting the Property

As of mid-May, the Federal Housing Finance Administration (FHFA) has relaxed standards for property appraisals.

Of course, you will still need a property appraisal. However, the FHFA has now ruled that appraisals can now be done remotely. There are two types of remote appraisals:

- Desktop appraisals – Desktop appraisals mean that the appraiser never leaves their desk. They carry out the market research, pull comps, and property values — without actually visiting the property. They use tax and MLS records to inform their decisions.

- Hybrid appraisals – A hybrid appraisal combines the desktop approach with some other resources to help determine a property’s value. These may include photographs of the property, a video-chat tour of the interior, or driving by the outside of the house.

If you’re selling a home in an area with enough recent sales or similar dimensions and conditions to others in the area, an alternative appraisal should be relatively straight-forward.

Contract Clauses – COVID-19 Addendums

A lot of people may have already been in the process of selling a property before COVID-19 swept across America. Those contracts and the world pre-lockdown seem like a lifetime ago now. With that in mind, lawyers are now trying to manage the risks and uncertainty posed by the coronavirus in the contracts they draw up.

The vast majority of existing real estate contracts already have ‘force majeure’ provisions. USLegal defines this as: “a provision in a contract that excuses a party from not performing its contractual obligations that become impossible or impracticable, due to an event or effect that the parties could not have anticipated or controlled.” With the global pandemic reasonably being described as an unanticipated event, this language should cover existing contacts drawn up pre-COVID.

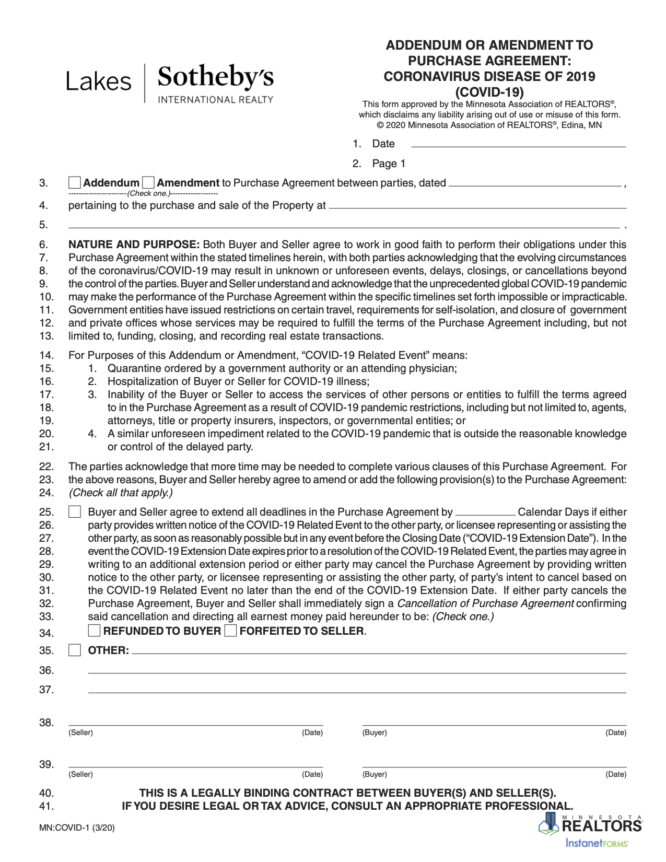

However, in order to not leave things up to interpretation, many states’ realtors associations are offering a standard COVID-19 addendum for buyers and sellers. Here’s an example of a coronavirus addendum used by Sotheby’s International Realty:

The addendum doesn’t grant a complete relaxation of the timeline; there still needs to be an agreed deadline extension and there are financial penalties if the deal falls through for either party. However, it does allow for further flexibility for buyers and sellers in case certain aspects of the deal are held up due to COVID-19, and if someone gets sick.

If you still can — even if you’re 99% done in the selling process — it’s worth suggesting an attachment of an addendum to your existing contact.

Document Signing – Virtual Signatures or Couriers

A lot of documentation involved in the process of closing can be signed virtually with an e-signing, you can use services such as Docusign or Hellosign. Despite not being carried out in person or with ink, these are still legally binding.

However, whether the closing can take place entirely online depends on your state’s stance on notarizations. Some states allow remote online notary services while others insist on notarization to take place in-person.

The coronavirus pandemic has resulted in some states changing their stance towards online notary services. For example, back in March New York authorized online notarization in response to COVID. The National Association of Realtors (NAR) is currently trying to extend these provisions federally, and you can find your state’s stance on the NAR’s website.

If this is allowed in your state, then virtual closing is a possibility. In fact, this was a practice that was being carried out more and more pre-COVID crisis. For transactions in states that don’t allow online notarizations, courier services such as FedEx and UPS may be an option to transport documentation between buyers and sellers.

WE LEND OFFERS A RANGE OF PROGRAMS TO SUIT EVERY TYPE OF RESIDENTIAL REAL ESTATE INVESTOR.

The Final Close

If you’re to finalize a sale, you’re going to have to execute it virtually or socially distanced, as per the above. It’s not quite business as usual, but closing a real estate transaction virtually during Covid-19 is enabling the industry to stay in motion.

The real estate industry is widely known to be behind on technology or a bit antiquated in its practices, but COVID-19 is propelling the advancement of real estate technology more in the past few months than in the past 10 years.

While you don’t have the satisfaction of a handshake to conclude your deal, as the lockdowns ease you may be able to start elbow bumping your attorney and realtor.